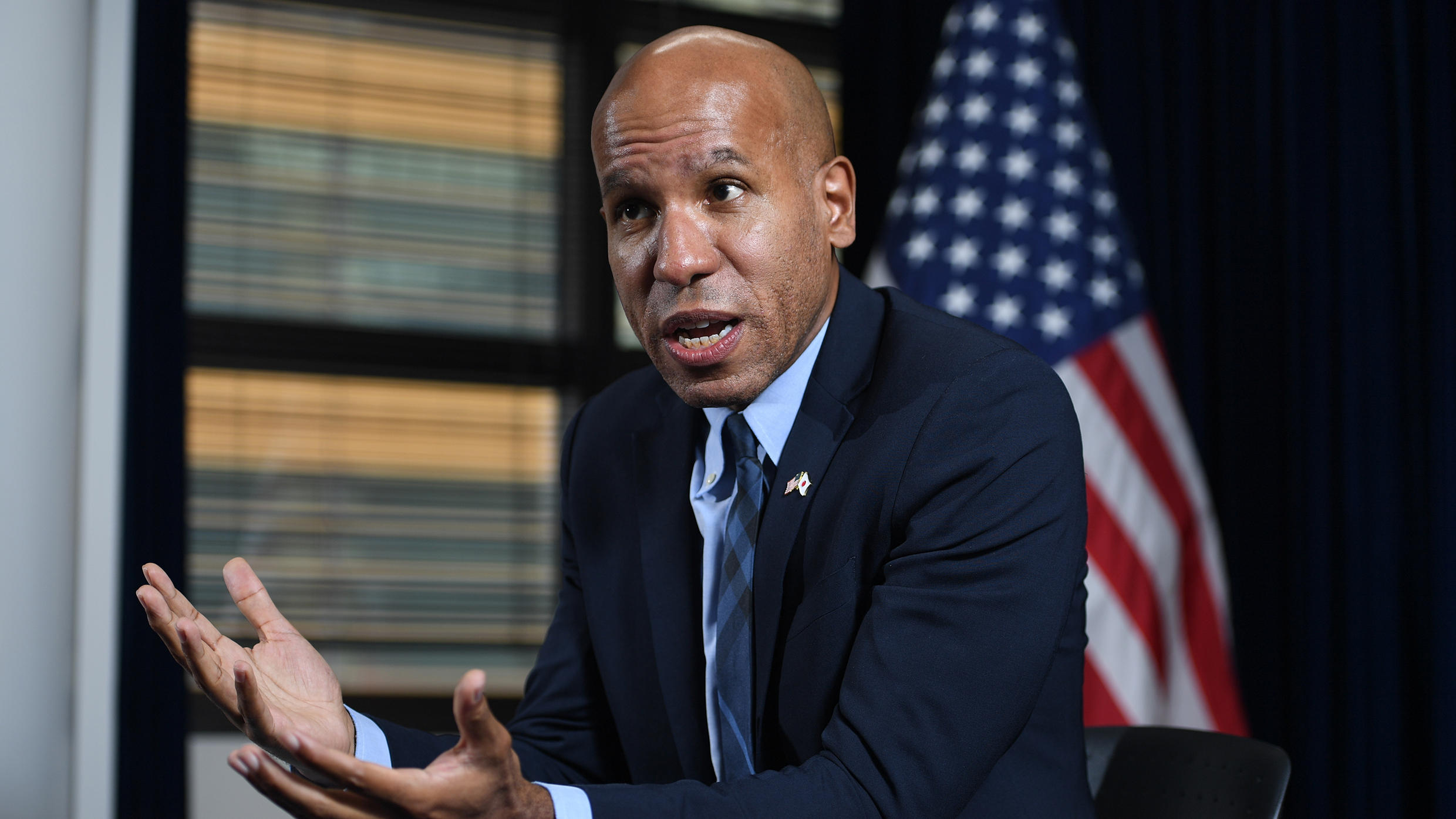

US Under Secretary in the Department of Treasury (Terrorism and Financial Intelligence), Brian Nelson, is on a three-day tour of Africa where he will visit Somalia and Kenya.

According to a media advisory from the Department of Treasury, Mr Nelson’s tour will seek to assert America’s commitment to strengthening financial connections with Africa.

Part of his will be a discussion on innovative solutions including development of fintechs and mechanisms of ensuring safe financial inclusivity for the fintech founders.

Also Read: Visa Announces $1 billion Initiative to Support Africa Fintech Startups

In Nairobi, Mr Nelson will hold a meeting with local fintech firms as part of his efforts to help develop a framework for supporting founders financially.

Brian Nelson to address Money Laundering & Terror Financing

What’s more, Nelson’s delegation will convene with government officials in both countries for a discussion touching on ways of strengthening anti-money laundering and countering the financing of terrorism.

The delegation will exchange ideas with local stakeholders on how to curtail the illicit flow of money and goods which contribute to instability in the Horn of Africa region.

“In Mogadishu, he will meet with government officials, the Somali Bankers Association, and the Money Transfer Business Association,” the statement read in part.

His visit comes against the backdrop of increased cases of money laundering in Africa especially in the wake of the growing use of fintechs for cash transfer.

Also Read: Europe-based IX Africa to Build Second Data Hub in Nairobi

Illicit flow of funds has been cited as a leading enabler of terror activities in the region as well as illegal trade hence prompting authorities to devise new mechanisms of governing financial flows.

In Kenya, for example, the government recently proposed a draft bill named the Anti-Money Laundering and Combating of Terrorism Financing Laws (Amendment) Bill of 2023 which seeks to further clampdown on illicit flow of money.

If enacted into law, the proposal will allow Kenya’s authorities to take stern actions against violators of Anti-Money Laundering regulations including revocation of licenses.