Village Capital has invested in two innovative startups, Kenya’s Aquarech and Nigeria’s CoAmana, through its Reducing Inequalities Investment Facility.

These investments aim to transform farmers’ lives in Sub-Saharan Africa. Since 2012, Village Capital has operated in Sub-Saharan Africa, running over 14 accelerator programs. It has supported over 120 startups and 78 Entrepreneur Support Organisations (ESOs) across 15 countries.

The focus areas include financial health, hardware, sustainability, and the future of work.This Reducing Inequalities Investment Facility, backed by FMO’s MASSIF Fund, supports financial inclusion through innovative financial solutions and inclusive businesses.

Also Read: AU Launches Startup Policy to Boost African Innovation

Aquarech Secures $350,000

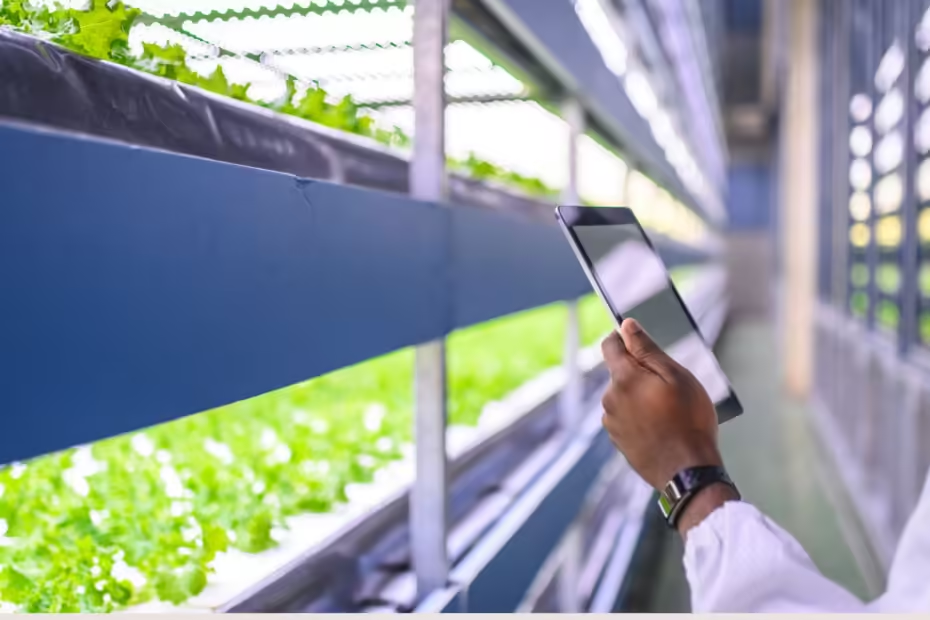

Aquarech, a Kenyan agri-tech startup, received $350,000. The company helps small and medium-sized fish farmers increase productivity and profitability.

It provides quality fish feed, credit, and market access. Dave Okech, co-founder and CEO of Aquarech, stated the importance of transitioning farmers to profitability.

“Our high-quality extruded floating pelleted fish feed, supported by a credit platform and market linkages, directly benefits farmers,” Okech said.

Heather Matranga, VP of impact investments at Village Capital added, “Aquarech enhances fish farmers’ livelihoods and generates employment for women and youth in rural areas. The company’s approach aligns with our mission to support impact leaders tackling rural inequality.”

CoAmana Receives $500,000

CoAmana, a Nigerian startup, secured $500,000 from the fund. It uses a top-down approach to enhance market management through its product, Amana Market.

CoAmana has built agent networks to onboard farmers and traders into the digital marketplace. This ensures access to information, high-quality inputs, and credit.

In her remarks, Hafsah Jumare, founder and CEO of CoAmana stated, “Village Capital has been a steadfast partner, understanding the communities and markets we serve. We are eager to enter the next chapter of our growth.”

Kavon Badie, investment officer at Village Capital further added, “CoAmana improves efficiencies by leveraging existing market structures. They provide access to credit and information on high-quality inputs, improving millions of smallholder farmers’ livelihoods.

“This investment aligns with our fund’s goal of fostering financial inclusion and reducing rural inequality. Aquarech and CoAmana are the third and fourth investments by the Reducing Inequalities Investment Facility.”

Previous investments include Apontech, a Bangladesh-based company enhancing financial inclusion for factory workers, and Crop2Cash, a Nigerian agri-tech startup empowering smallholder farmers.