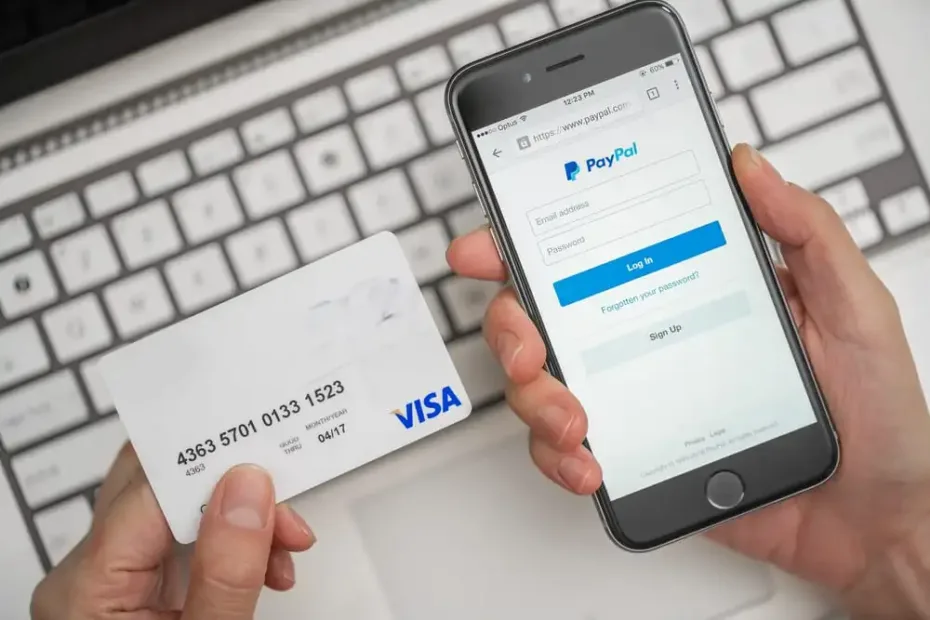

Pyypl, a fintech firm in the Middle East and Africa (MEA), has announced a major partnership with Visa. This collaboration allows Pyypl to issue both virtual and physical prepaid Visa cards.

Through a Principal Licence membership and strategic framework agreement with Visa, Pyypl can accelerate its international expansion. This partnership aims to democratize access to financial services across the Gulf Cooperation Council (GCC) and Africa.

Pyypl’s Principal Licence also allows it to issue Visa cards directly to its users through its mobile app. This move benefits hundreds of thousands of active users. Additionally, the support of local regulators enables Pyypl to provide Visa cards in other markets, promoting financial inclusion across MEA.

Visa’s growth and innovation strategy aligns with this partnership. It aims to enhance financial capabilities for 850 million digital natives in MEA.

Also Read: Ukheshe Rebrands as EFT Corporation to Lead Financial Inclusion in Africa

Benefits of New Partnership for Underserved Digital Natives

In his remarks, Antti Arponen, CEO and co-founder of Pyypl stated,

“Our payments ecosystem has multiple benefits for Visa and will accelerate the provision of financial services to the vast population of underserved digital natives in the region.

“Working closely with Visa and local regulators in new markets, we are focused on growing Pyypl’s presence and contributing to advancing financial inclusion across the region.”

Hasan Kazmi, Visa’s VP of strategic partnerships and ventures for CEMEA, added,

“We are delighted to welcome Pyypl to our mission of advancing financial inclusion. We believe in empowering underbanked consumers by providing them with innovative, secure payment solutions. This not only gives them access to the digital economy, but also helps them thrive in this increasingly digital age.”

Pyypl is powered by proprietary technology. It operates in multiple markets across Africa and the GCC. It aims to transform financial services for 850 million underserved smartphone users in the region.

Pyypl also offers virtual and physical prepaid cards, instant domestic and international transfers, and remittances to 80 countries through a single app.