Interswitch East Africa, a major player in digital payments, has announced a partnership with Elie Technologies, trading as Tuma, to launch Tumatap in Kenya.

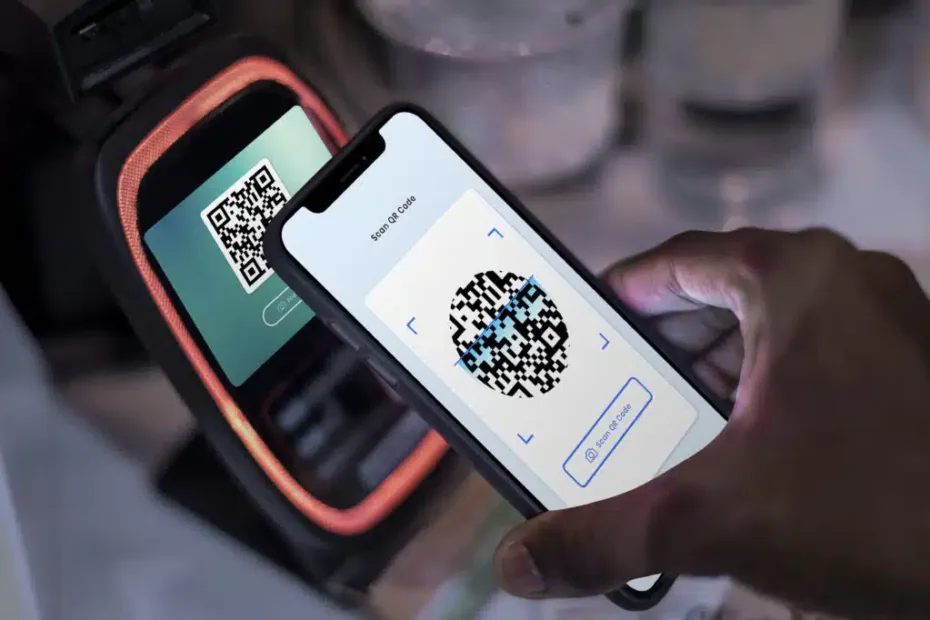

This new contactless payment solution will transform smartphones into point-of-sale (POS) systems, allowing MSMEs to accept card payments without extra equipment.

Tumatap will work on any Android, iOS smartphone, or feature phone, making it accessible to many businesses. By turning smartphones into powerful POS systems, this technology eliminates the need for traditional hardware. This innovation is expected to drive financial inclusion among small business owners across Kenya.

Real-Time Transactions and Enhanced Security

The Central Bank of Kenya recently approved Interswitch to switch and process card transactions for Tumatap merchants.

This collaboration combines Elie Tech’s innovative soft POS technology with Interswitch’s secure switching and processing capabilities.

Together, they offer real-time transaction processing, providing a seamless and secure experience for merchants and customers.

The strategic partnership aims to improve business operations by offering valuable insights from real-time transaction data.

Merchants will be able to track customer behavior and optimize performance, leading to better business decisions. This is particularly beneficial for MSMEs, helping them cut transaction costs and improve operational efficiency.

Also Read: Flutterwave Secures License to Expand Payment Solutions in Uganda

Expanding Digital Payments for Diverse Sectors

Tumatap will cater to a variety of sectors, including Hotels, Restaurants, Bars, Wines and Spirits outlets, Cosmetics and Spas, Pharmaceutical shops, and small retail kiosks. The wide-reaching solution ensures that businesses of all sizes benefit from the technology.

Peter Kawumi, Regional Managing Director of Interswitch East Africa, highlighted the benefits of the partnership. He stated, “We are committed to building a financially inclusive ecosystem. This collaboration reinforces that commitment by reshaping the payment landscape.”

Wesley Masinde, Co-Founder of Tuma, echoed Kawumi’s sentiments, noting that Tumatap empowers small businesses to enhance their payment processes and grow.

“This partnership is a game-changer for MSMEs in Kenya. It combines our soft POS technology with Interswitch’s switching and processing capabilities,” he said.

Interswitch Driving Financial Inclusion in Kenya

Interswitch and Tuma will revolutionize Kenya’s digital payments landscape. By offering a simple, cost-effective alternative to traditional processing, Tumatap aligns with evolving customer preferences. Consumers can tap their cards or devices on a merchant’s phone for quick, convenient checkouts.

Interswitch’s continued expansion and introduction of new technologies highlight its commitment to making digital payments accessible, secure, and beneficial for everyone.

This partnership marks another step forward in Interswitch’s mission to drive financial inclusion and advance the digital economy in Kenya.