The African Development Bank’s Board of Directors have decided to invest $10.50 million in the Seedstars Africa Ventures(SAV) venture capital fund.

This investment will help support innovative African businesses that have the potential for significant growth.

The Bank plans to contribute $7 million from its regular funds and $3.5 million from the European Union Boost Africa program.

This investment will help Seedstars Africa Ventures to raise more funds, expand its operations in Africa, and attract other investors.

Seedstars Africa Ventures is a fund that invests in early-stage companies with high growth potential in Sub-Saharan Africa.

The fund looks for businesses with great potential that are already making money and solving important problems in the market.

It mainly focuses on Sub-Saharan Africa, especially in places that traditional investors don’t cover much.

It pays special attention to French-speaking countries like Senegal, Côte d’Ivoire, Benin, and Cameroon, but also invests in Ghana, Uganda, and Tanzania.

Read Also: EIB Invests $30M in Seedstars Africa to Boost Innovation.

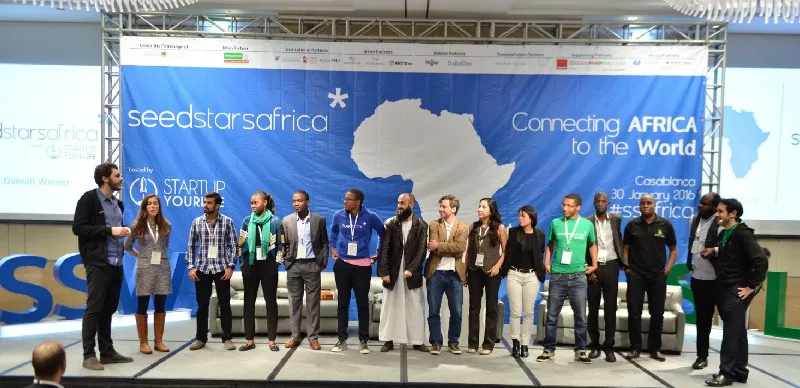

Seedstars Africa Ventures’ Initiatives in Africa

Seedstars Africa Ventures is a $75 million venture capital fund that supports businesses in their early stages, and helps them overcome market challenges.

They initially invest around €250,000 and later add more money, up to €5 million, to help these businesses grow.

SAV targets various sectors, including financial inclusion and technologies that help businesses platforms for retail sales and logistics that focus on online and mobile consumers.

They also target health-related technologies, pre-paid, off-grid energy and the overall adoption of technology in businesses, particularly food-processing and value chains.

The fund is expected to create 9,000 full-time jobs, with half of them for women, resulting in a significant economic impact.

The fund’s goals align with Boost Africa, which focuses on investing in growing startups with a positive social impact.

This supports the African Development Bank’s strategy and also connects entrepreneurship and investment to reduce poverty and promote sustainable development.

The investments will also back the Bank’s priorities in key sectors like agriculture, health, industrialization, and off-grid energy.

This will contribute to regional integration and improve lives in Africa.