Kenya’s fuel prices surged following the enactment of a tax law that allowed the state to double Value Added Tax (VAT) on fuel products from 8 percent to 16 percent.

On June 30, the Energy and Petroleum Regulatory Authority (EPRA)- the body mandated to control fuel prices in Kenya- released new rates that set the price of Super Petrol at a record high of $1.40 per liter.

The announcement pushed pump prices to an all-time high in the East African economic power house that is grappling with skyrocketing inflation.

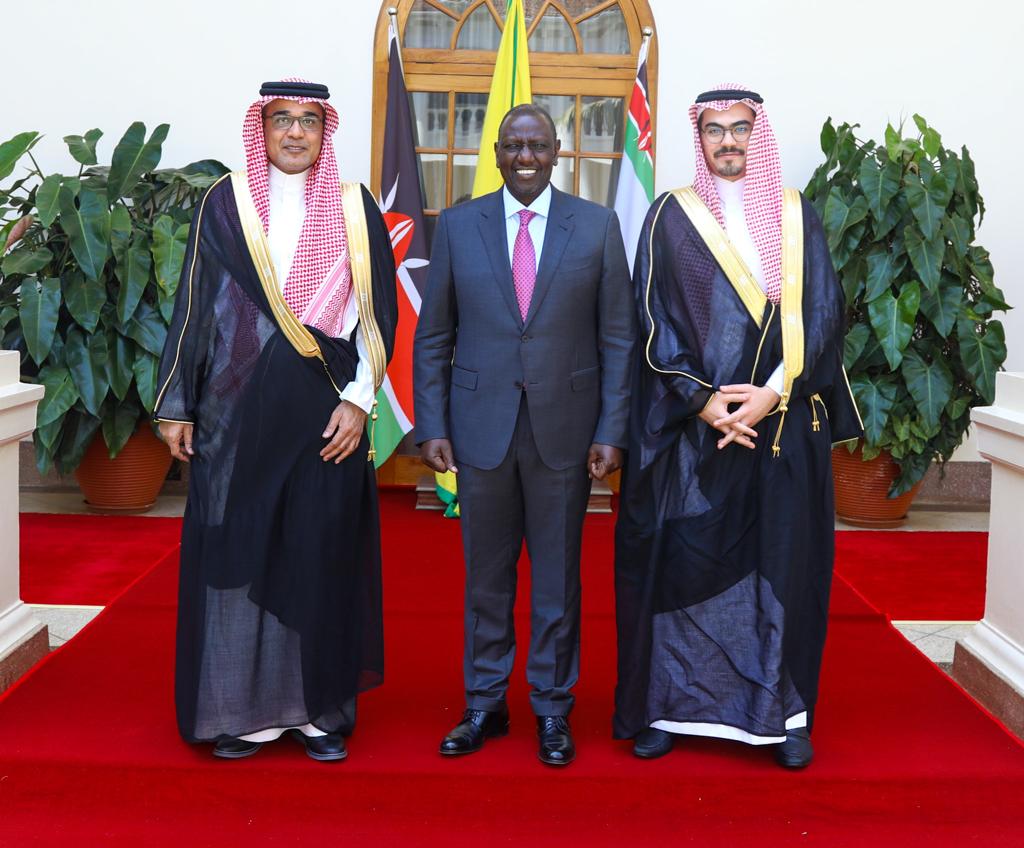

Kenya, Saudi Oil Deal

In March 2023, Kenya reached an agreement with the governments of the United Arab Emirates (UAE) and Saudi Arabia with the aim of easing the dollar shortage pressure among oil importing companies in the country.

This came after it emerged that occasional lack of access to dollars by local oil marketers partly caused shortage of oil and piled pressure on the devaluating shilling.

The deal would allow Kenyan oil marketers to import oil from Saudi and UAE on credit for six months and later offset the cumulative amount in a lump sum at the expiry of the agreed period.

Announcing the agreement, Kenya’s Energy Cabinet Secretary Davis Chirchir noted that oil marketers in the country would have an option to pay in Kenyan currency (shillings) and thus easing the pressure for the fast-weakening currency.

“Also, IOC’s (International Oil Companies) will be free to pay using the Kenyan Shilling to ease spot pressure on the dollar,” Chirchir noted.

Kenya’s fuel prices amid weak shilling

Three months into the deal, however, the shilling is yet to show signs of an imminent rebound against the dollar. Instead, the currency hit an all-time low against the dollar with the current exchange rate of over 136.

The prices of oil products have also remained high throughout this period.

Economic experts warned of a possible ripple effect where high transport and production costs will likely exacerbate the already high cost of living.

President William Ruto, who took over the country’s leadership in September 2022, is also staring at civil disobedience with the opposition rejecting his economic policies.

To his defense, Ruto argues that some global factors including the war in Ukraine affected the country’s economy leading to the high cost of living.

Kenya has over the last couple of months suffered adversely from global economic trends such as the dollar shortage, the war in Ukraine, and a ravaging drought, the “worst in decades”.

Kenya’s economic struggle

In addition, the country has hit alarming debt levels, a situation the government notes will play a factor in some of the decisions concerning the state of the economy.

Consequently, the government has turned to alternative ways of raising revenue including new taxes and increased taxes as part of the efforts to recover from its debt quagmire.

Furthermore, the government scraped fuel subsidies initially put in place to cushion citizens from high global prices.

In May, the International Monetary Fund (IMF) commended efforts by the government to guide Kenya towards economic recovery noting that the medium-term outlook was favorable.

Despite being adamant that the fiscal policies adopted by the government including new taxes will eventually bear fruits, dealing with the resulting political environment remains a puzzle for President Ruto.

A Senator has already secured a stay order barring the government from implementing the tax measures until a case filed before the High Court is heard and determined.

Additionally, the opposition faction has hinted at possible mass action to protest against the tax measures.